Looking at the tuition and fees page on college websites can be enough to make your jaw drop. Thankfully, few end up paying the full sticker price for a degree. Between loans, scholarships, and financial aid, there are numerous options to make college more affordable.

If you’ve opened a state-sponsored, tax-advantaged 529 college savings plan, you’re already off to a great start. But how does your 529 plan factor into your larger strategy to pay for your child’s education? And how much of that strategy have you discussed with them?

How America Pays for College

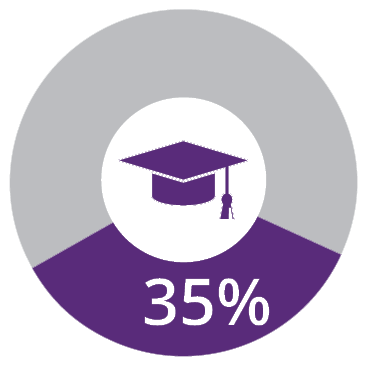

Only 35% of America’s college savings are held in 529 accounts, even though parents who take advantage of these investment vehicles can amass higher average amounts than the majority who stash cash in savings and checking accounts.1

How Parents Fund Their Share of College Costs

Current Income

Other Savings or Investments

529 College Savings Plans

Source: Sallie Mae, “How America Pays for College 2024,” 8/24

A growing number of families—59%—say they have a plan to pay for the full cost of college before a student enrolls, and 44% say they make the final decision about how to pay for college together.1 Has your family had this conversation?

Parental Expectations

Most parents view minimizing college costs as a priority, with 74% helping to pay for their child's education.1 On average, parents aim to save $55,342 to help cover these costs.2 In addition to the average parental savings, most expect the cost of college to be a burden shared between parents and student.

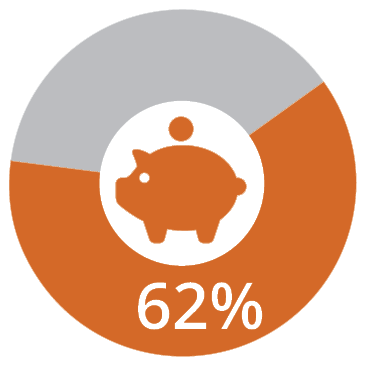

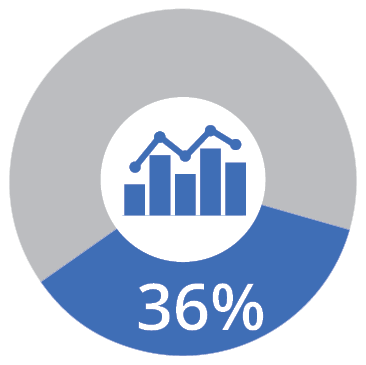

On average, parents contributed roughly 37% of the total college education costs in the 2023-24 school year.1 The remainder is funded through a combination of student income, scholarships, grants, federal student aid, loans, and gifts from family. Even though many families are saving for college, 62% of families who borrow say that was always part of their plan.1

Relaying Expectations to Children

When it comes to paying for college, closing the parent-child communication gap is important. In order to make the overwhelming task more manageable, it’s best to create a plan and be transparent with your child about that plan so you can work together.

The first step, which should be ongoing throughout your child’s primary and high school education, is to consult your financial professional.

If you’re using a 529 plan, you’re already taking advantage of a tool that may enable you to save more than the average parent who is using a savings or checking account. Your financial professional can serve as a resource for maximizing the potential of your child’s 529 plan within your individual family and financial situation.

The second step is to discuss with your child who will pay for tuition and fees before they apply for college.

Have you explained what a 529 is? Should they plan to apply for grants and scholarships? Have you explained the benefits of attending public, in-state school? Are they aware of other ways to make college more affordable?

Consider setting your child up with a solid foundation to finance his or her future with a 529 plan. Then help build on that foundation by having honest, open conversations.

On Target to Meet Your Goals?

Even if your goals are appropriate given your family’s circumstances, what about your savings rate? Do you think that you’ll achieve your goal? Talk with your financial professional, and check out the College Savings Planner calculator at smart529.com/resources/calculator. Simply plug in a few numbers to find out if you’re on track to save enough.

What Is a 529 Plan?

- A 529 plan is a state-sponsored, tax-advantaged savings account that grows tax free.

- The account owner retains control over the account, even after the beneficiary reaches 18. Beneficiaries can be changed or transferred easily.

- Fees and expenses vary by state, as do tax advantages.

- Returns are not guaranteed, and you could lose money by investing in a 529 plan.

- Non-qualified withdrawals are taxable as ordinary income to the extent of earnings and may also be subject to a 10% federal income tax penalty.