SMART529 WV Direct offers a variety of investment portfolios tailored to individual investors' savings needs.

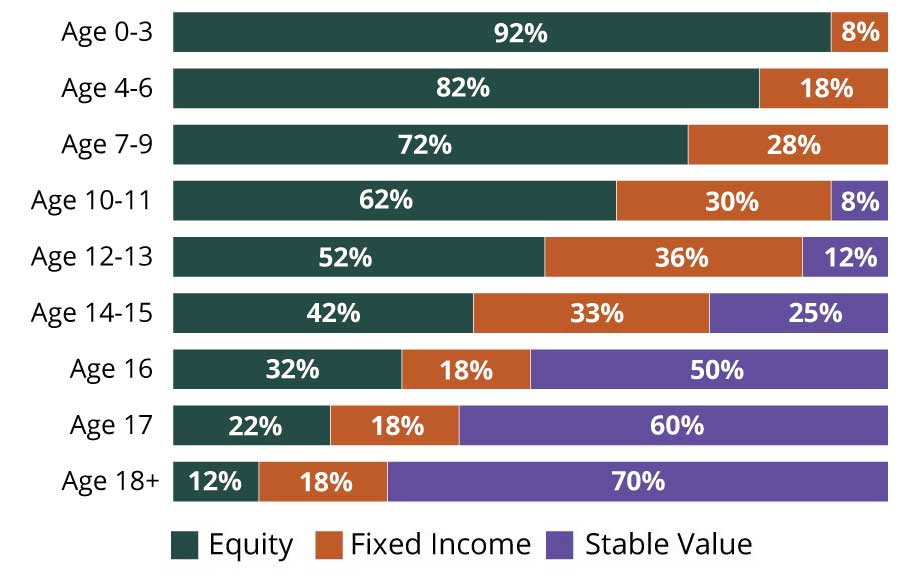

As their name suggests, Age-Based Portfolios are tailored for children in a particular age group. As your beneficiary gets older, your investment is automatically rebalanced from a more aggressive mix early on to a more conservative one as college nears.

Tax-free transfers between investment options are allowed twice per calendar year.

| Fund | Age-Based Portfolios | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 0-3 | 4-6 | 7-9 | 10-11 | 12-13 | 14-15 | 16 | 17 | 18+ | |

| Vanguard Total Stock Market Index | 62.75% | 56.00% | 49.00% | 42.25% | 35.50% | 28.50% | 21.75% | 15.00% | 8.25% |

| Vanguard Total International Stock Index | 29.25% | 26.00% | 23.00% | 19.75% | 16.50% | 13.50% | 10.25% | 7.00% | 3.75% |

| Vanguard Total Bond Market II Index | 8.00% | 12.50% | 19.00% | 20.50% | 24.50% | 22.50% | 11.00% | 11.00% | 11.00% |

| Vanguard Inflation-Protected Securities | 0.00% | 5.50% | 9.00% | 9.50% | 11.50% | 10.50% | 7.00% | 7.00% | 7.00% |

| The Smart529 Stable Value Portfolio | 0.00% | 0.00% | 0.00% | 8.00% | 12.00% | 25.00% | 50.00% | 60.00% | 70.00% |

| 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | |

* Exception: SMART529 Stable Value Portfolio is managed by Invesco Advisers, Inc. and it is not a mutual fund.

Holdings are subject to change.

Vanguard and Invesco Advisers, Inc. are not affiliates or subsidiaries of Hartford Funds. For more information on the specific risks of these portfolios, please see the Offering Statement.

SMART529 WV Direct offers a variety of investment portfolios tailored to individual investors' savings needs.

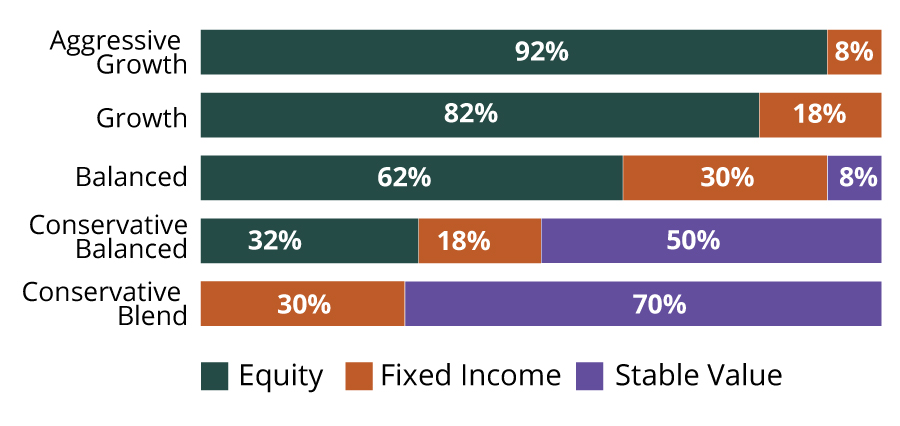

Because investors differ in how long they plan to invest and how much risk they are willing to take, SMART529 also offers preset Static Portfolios ranging from an aggressive growth selection to more conservative choices. Tax-free transfers between investment options are allowed twice per calendar year.

SMART529 WV Direct offers a variety of investment portfolios tailored to individual investors' savings needs. Tax-free transfers between investment options are allowed twice per calendar year.

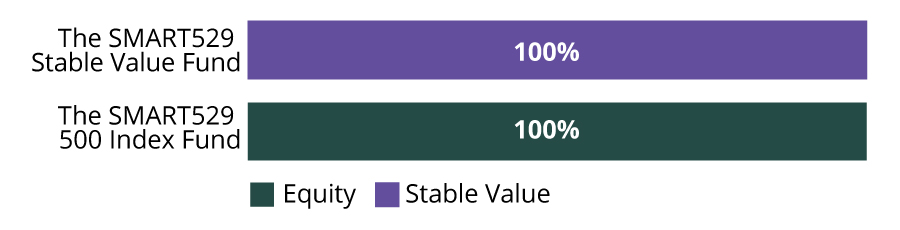

- The SMART529 Stable Value Portfolio: This portfolio seeks to maximize current income while preserving principal and delivering stable investment returns. The portfolio invests 100% in an account managed by Invesco Advisers, Inc.

- The SMART529 500 Index Portfolio: This portfolio seeks to track the performance of a benchmark index that measures the investing return of large-capitalization stocks. The portfolio invests 100% in the Vanguard Institutional Index Fund.

For more information on the specific risks of these portfolios, please see the Offering Statement.

Equity |

|

|

Fixed Income |

|

|

Stable Value |

|